Amazon’s stock price goes up as its margins decline. Will investors continue to believe? Will the ever fickle Millennials stick with Amazon or will it become “where grannies shop” mimicking the trend of Facebook which has lost favor with Millenials. Will the burden of all of the infrastructure Amazon is putting in to support same-day shipping be worth it to consumers or will they trade time for money and go with low infrastructure solutions like Alibaba? Get out your crystal ball!

Retail in 25 years: Amazon’s dominance or demise?

By John Jannarone

Amazon has grown into a juggernaut capable of toppling established leaders across the retail industry. If the company keeps rolling for another 25 years, companies in even more sectors will fight to protect their turf. Will Amazon prevail or dry up?

Amazon, founded just 20 years ago, appears to defy rules that most rivals are forced to follow. As the company focused on winning market share, it has faced little pressure to generate profits, allowing it to invest heavily and offer prices rivals can’t match. And it’s hard to guess when that advantage will go away.

Read More: For once, Amazon won’t leave a path of destruction

Getty ImagesAmazon.com founder and CEO Jeff Bezos speaks at a news conference on June 18, 2014, in Seattle, Washington

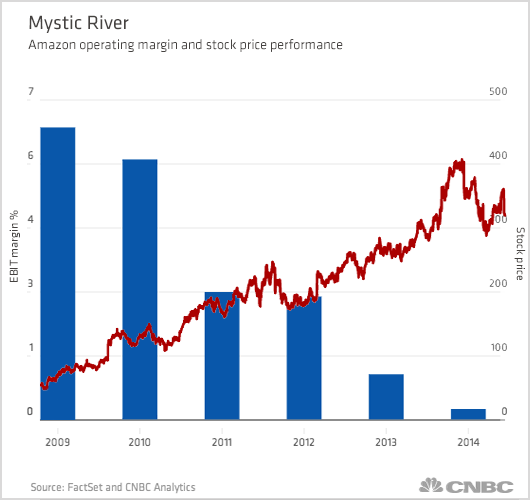

Getty ImagesAmazon.com founder and CEO Jeff Bezos speaks at a news conference on June 18, 2014, in Seattle, WashingtonJust consider the company’s performance: Amazon’s operating margin is expected to be a razor-thin 0.2 percent in 2014, according to consensus estimates, reflecting a decline from 6.4 percent in 2009. After interest and taxes, the company often has losing quarters. Meanwhile, Amazon stock has continued to soar. While it has seen a 20 percent pullback so far in 2014, it remains up sixfold since the start of 2009.

Along the way, Amazon has contributed to a drastic transformation of the retail industry. Some of the most vulnerable retail categories have already seen major brick-and-mortar players vanish as sales moved online. In books, Borders and many smaller booksellers have folded. The trend has been similar in electronics, with Circuit City shutting its doors and Best Buy losing its footing. Amazon declined to comment to CNBC.

In years to come, there’s little doubt that more retail categories will move further online. Greg Melich, a leading retail analyst at ISI group, points out that several categories, including toys, sporting goods and office products, are still purchased online less than 25 percent of the time. Over the next quarter century, there is potential for the online share to grow dramatically across those categories, he said.

Controlling the retailer

The next big step for Amazon may be going further than competing with retailers on identical products. In categories where companies produce unique products such as fashion, Amazon may want to manage their online presence entirely.

Fashion houses Elie Tahari and Kate Spade, for instance, have their own websites where shoppers can order products. But they also have branded sections on Amazon’s website where shoppers can purchase a wide range of their products. Laura Lapitino, senior public relations spokesperson for Elie Tahari, declined to comment, as did Kate Spade.

Some growth-stage businesses explain that there’s a temptation to let Amazon run their online presence entirely. That’s a tough decision for companies that have dedicated immense amounts of time and money to shape their own desire to have close control over their brand and image.

Active-apparel firm Scottevest, which has more than $10 million in annual revenue, sells through its own website as well as Amazon. But CEO Scott Jordan said he can imagine a day when companies like his sell only through Amazon because it can ship and process orders for much less than he can do on his own.

“Amazon makes a convincing case for it, to be honest,” Jordan told CNBC.com. Still, he added that Amazon charges extra for items like marketing fees, which make the offer less appealing.

Luxury goes it alone

Luxury is one category where companies may fight hard to maintain independent sites. Yoox, which is listed in Milan, specializes in building websites for high-end stores, including Valentino, Brunello Cucinelli and Moncler. The company has a centralized system that offers shipping and processing services while allowing luxury brands to maintain their own virtual storefronts.

Yoox CEO Federico Marchetti said he believes luxury brands “will always want to offer selective and vertical shopping experiences: no widespread distribution and no marketplaces with proximity to mass-market brands or unrelated goods.”

He added that while some luxury brands sell wholesale to third-party sites, he expects a continued shift toward single-name sites. “Online mono-brand flagship stores will become the majority of their online turnover—just as we have seen in physical retail over the years. It could take five, 10, or 25 years, depending on the brand and its management, but I am confident that online direct retail will take over online wholesale for luxury brands.”

Read MoreInvestors are fed up with Amazon, says analyst

Marchetti also believes that physical stores will remain part of the luxury shopping experience, even in 25 years. “The difference between now and then is that the luxury houses’ mono-brand online flagship stores and their physical flagships will be completely and seamlessly integrated,” he said.

New technology

Other e-commerce experts say technological changes will alter the shopping experience so dramatically that a marketplace framework like Amazon’s could become obsolete. “I still see way too much friction in the e-commerce experience,” said Fiona Dias, chief strategy officer for ShopRunner, which operates a fixed-rate service giving customers unlimited shipping across a network of retailers. ShopRunner’s partner retailers include luxury department store Neiman Marcus, apparel company Brooks Brothers and health and wellness retailer GNC.

Dias said that the idea of going to a marketplace like Amazon’s is far too cumbersome and that retailers will continue looking for ways to connect directly with their consumers. “The marketplace is like e-commerce on training wheels,” she said. “Once retailers can get over that, it’s possible to create a seamless experience. I see a world where it’s “I see it, I love it, I want to get it, and it’s on the way.'”

For its part, Amazon is already working on ways to keep the consumer captive. Offerings like access to a big streaming video library, which are part of its $99-a-year Prime that also includes limitless shipping on most items, surely help. It is also working on delivering packages with unmanned drones.

But Dias believes that retail 25 years from now will differ in ways no one can yet predict. “It will probably be something that comes out of left field,” she said. “It’s still science fiction.”

Amazon worker piloted drone around Space Needle

—By CNBC’s John Jannarone